Embark on a journey towards financial empowerment with our comprehensive Dave Ramsey Chapter 4 Answer Key. This guide unveils the secrets to Dave Ramsey’s renowned Baby Steps, empowering you with the knowledge and strategies to achieve your financial goals and secure your financial future.

Within these pages, you will discover the intricacies of creating a budget, managing debt effectively, investing wisely, and safeguarding your assets. Our expert insights and practical examples will equip you with the tools and confidence to navigate the complexities of personal finance and achieve financial freedom.

Dave Ramsey’s Baby Steps

Dave Ramsey’s Baby Steps are a seven-step financial plan designed to help individuals achieve financial freedom. The steps are designed to be followed in order, and each step builds on the previous one. The goal of the Baby Steps is to eliminate debt, build an emergency fund, and invest for the future.

Baby Step 1: $1,000 Emergency Fund

The first step is to save up $1,000 for an emergency fund. This fund will be used to cover unexpected expenses, such as a car repair or a medical bill. Having an emergency fund will help you avoid going into debt when an unexpected expense arises.

Baby Step 2: Pay Off All Debt (Except the House) Using the Debt Snowball

The second step is to pay off all of your debt, except for your mortgage, using the debt snowball method. The debt snowball method involves paying off your smallest debt first, regardless of the interest rate. Once you have paid off your smallest debt, you move on to the next smallest debt, and so on.

This method will help you build momentum and stay motivated as you pay off your debt.

Baby Step 3: Save 3-6 Months of Expenses in a Fully Funded Emergency Fund

The third step is to save 3-6 months of expenses in a fully funded emergency fund. This fund will provide you with a financial cushion in case of a job loss or other financial emergency. Having a fully funded emergency fund will give you peace of mind and help you avoid going into debt if an emergency arises.

Baby Step 4: Invest 15% of Your Household Income in Retirement

The fourth step is to invest 15% of your household income in retirement. This will help you build a nest egg for your future. The earlier you start investing, the more time your money will have to grow. There are many different ways to invest, so talk to a financial advisor to find the best option for you.

Baby Step 5: Save for Your Children’s College Fund

The fifth step is to save for your children’s college fund. The cost of college is rising every year, so it’s important to start saving early. There are many different ways to save for college, so talk to a financial advisor to find the best option for you.

Baby Step 6: Pay Off Your Home Early

The sixth step is to pay off your home early. This will save you a significant amount of money on interest. There are many different ways to pay off your home early, so talk to a financial advisor to find the best option for you.

Baby Step 7: Build Wealth and Give, Dave ramsey chapter 4 answer key

The seventh step is to build wealth and give. Once you have achieved financial freedom, you can start building wealth and giving back to your community. There are many different ways to build wealth and give, so talk to a financial advisor to find the best option for you.

Budgeting and Debt Management

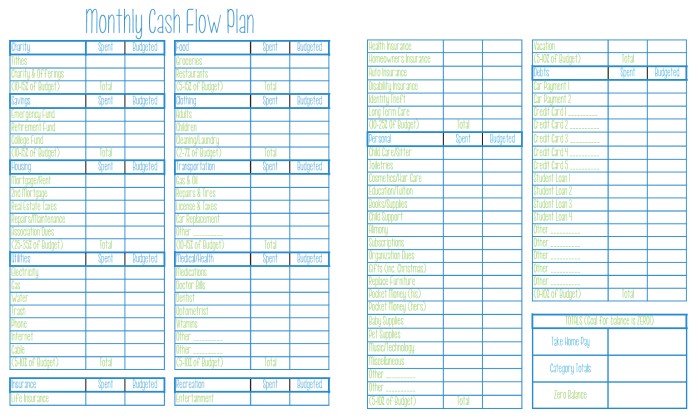

Effective budgeting and debt management are crucial aspects of Dave Ramsey’s Baby Steps. Creating a budget helps individuals track their income and expenses, enabling them to make informed financial decisions and achieve their financial goals.

To create an effective budget, it is essential to list all sources of income and categorize expenses into essential (e.g., housing, food, transportation), discretionary (e.g., entertainment, dining out), and savings. This comprehensive approach provides a clear understanding of financial inflows and outflows, allowing individuals to identify areas for potential savings and debt repayment.

Tips for Effective Budgeting

- Use budgeting software or mobile apps for ease of tracking.

- Review and adjust the budget regularly to reflect changes in income or expenses.

- Seek professional guidance from a financial advisor if needed.

Methods for Paying Off Debt

Once a budget is established, individuals can prioritize debt repayment using various methods:

Debt Snowball Method

This method involves paying off the smallest debt first, regardless of interest rate. As each debt is paid off, the freed-up funds are applied to the next smallest debt, creating a snowball effect.

Debt Avalanche Method

In contrast, the debt avalanche method focuses on paying off the debt with the highest interest rate first. This approach minimizes the total interest paid over time.

The choice between the debt snowball and debt avalanche methods depends on individual circumstances and preferences. The debt snowball method can provide psychological motivation, while the debt avalanche method can save more money in interest.

Investing and Retirement Planning: Dave Ramsey Chapter 4 Answer Key

Investing is essential for growing your wealth and securing your financial future. It involves putting money into various financial instruments, such as stocks, bonds, and real estate, with the goal of generating income and capital appreciation. Retirement planning, on the other hand, focuses on saving and investing for the time when you stop working and need to support yourself financially.

Investment Options

There are numerous investment options available, each with its own risk and return profile. Stocks represent ownership in a company and have the potential for high returns but also carry higher risk. Bonds are loans made to companies or governments and offer lower returns but are generally considered less risky than stocks.

Real estate involves investing in property, either directly or through investment trusts, and can provide rental income and potential appreciation in value.

Importance of Retirement Savings

Saving for retirement is crucial because it allows you to accumulate funds to support yourself financially during your golden years. Social Security benefits may not be sufficient to cover all your expenses, and relying solely on savings from your working years can be risky.

Starting to save early and investing wisely can significantly increase the size of your retirement nest egg.

Compound Interest

Compound interest is a powerful force that can exponentially increase your savings over time. It is the interest earned on your initial investment, plus the interest earned on the accumulated interest. The longer you invest, the more time compound interest has to work its magic and grow your wealth.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Albert Einstein

Protecting Your Assets

Protecting your assets is crucial for safeguarding your financial well-being and ensuring your future financial security. Adequate insurance coverage plays a vital role in mitigating potential risks and minimizing the financial impact of unexpected events.

Types of Insurance

There are several types of insurance available to protect your assets, including:

- Life Insurance:Provides financial support to your loved ones in the event of your untimely demise.

- Health Insurance:Covers medical expenses incurred due to illness or injury.

- Homeowners Insurance:Protects your home and its contents against damage or loss due to fire, theft, or other covered events.

- Auto Insurance:Covers your vehicle against damage or loss, as well as providing liability protection in case of an accident.

- Disability Insurance:Provides income replacement if you are unable to work due to illness or injury.

Finding Affordable Insurance

Finding affordable insurance is essential for protecting your assets without breaking the bank. Here are some tips to help you secure cost-effective coverage:

- Shop around:Compare quotes from multiple insurance providers to find the best rates.

- Increase your deductible:Choosing a higher deductible can lower your monthly premiums.

- Bundle policies:Combining multiple policies with the same provider can often result in discounts.

- Take advantage of discounts:Ask about discounts for good driving records, home security systems, or other qualifying factors.

- Negotiate with your provider:Don’t be afraid to negotiate with your insurance provider to secure the best possible rates.

Giving and Estate Planning

Giving back to the community is a vital aspect of a well-rounded life. It fosters a sense of purpose, strengthens community bonds, and creates a positive impact on society. There are numerous ways to give, including volunteering time, donating money, and mentoring others.Volunteering

allows individuals to contribute their skills and time to causes they care about, directly benefiting the community. Donating money to charitable organizations provides financial support for programs and services that address various societal needs. Mentoring offers guidance and support to individuals, helping them reach their potential and succeed in life.Estate

planning is crucial for ensuring that one’s wishes are respected and assets are distributed according to their intentions. Creating a will allows individuals to designate beneficiaries, appoint an executor, and make specific requests regarding their property and assets. Proper estate planning helps avoid disputes, ensures a smooth transition of assets, and provides peace of mind for loved ones.

Volunteering

Volunteering offers a range of benefits, both for the individual and the community. It provides opportunities for personal growth, skill development, and meaningful connections. Volunteering can also reduce stress, improve physical and mental health, and foster a sense of belonging.

Donating Money

Donating money to charitable organizations is a direct way to support causes and initiatives that align with one’s values. It allows individuals to contribute to the well-being of others and make a tangible difference in their lives. Charitable donations can also provide tax benefits, reducing the financial burden of giving.

Mentoring

Mentoring involves sharing knowledge, skills, and experiences with others, guiding them towards personal and professional growth. Mentors provide support, encouragement, and advice, helping mentees overcome challenges and achieve their goals. Mentoring can have a profound impact on both the mentor and the mentee, fostering a sense of purpose and fulfillment.

Creating a Will

Creating a will is an essential part of estate planning. It allows individuals to clearly Artikel their wishes regarding the distribution of their assets, appointment of an executor, and other end-of-life matters. A will helps avoid disputes, ensures that one’s intentions are respected, and provides peace of mind for loved ones.

Importance of Estate Planning

Proper estate planning ensures that one’s assets are distributed according to their wishes and that their loved ones are taken care of. It minimizes the risk of disputes, reduces the burden on family members, and provides peace of mind. Estate planning also allows individuals to make arrangements for their end-of-life care, ensuring that their wishes are respected and their affairs are handled in a dignified and orderly manner.

Essential Questionnaire

What is the first Baby Step?

The first Baby Step is to save $1,000 for a starter emergency fund.

How can I get out of debt quickly?

Consider using the debt snowball method to pay off your debts faster.

What is the importance of compound interest?

Compound interest allows your investments to grow exponentially over time.