Which of the following is a characteristic of adjusting entries? This question delves into the intricacies of accounting practices, shedding light on the crucial role of adjusting entries in ensuring the accuracy and reliability of financial reporting. Adjusting entries, a fundamental aspect of the accounting cycle, play a pivotal role in aligning financial records with the accrual basis of accounting, a cornerstone of modern accounting practices.

Adjusting entries are not merely technical accounting procedures; they are essential for presenting a true and fair view of a company’s financial position and performance. By incorporating the effects of transactions that have occurred but have not yet been recorded, adjusting entries provide a more comprehensive and accurate representation of an organization’s financial health.

Characteristics of Adjusting Entries: Which Of The Following Is A Characteristic Of Adjusting Entries

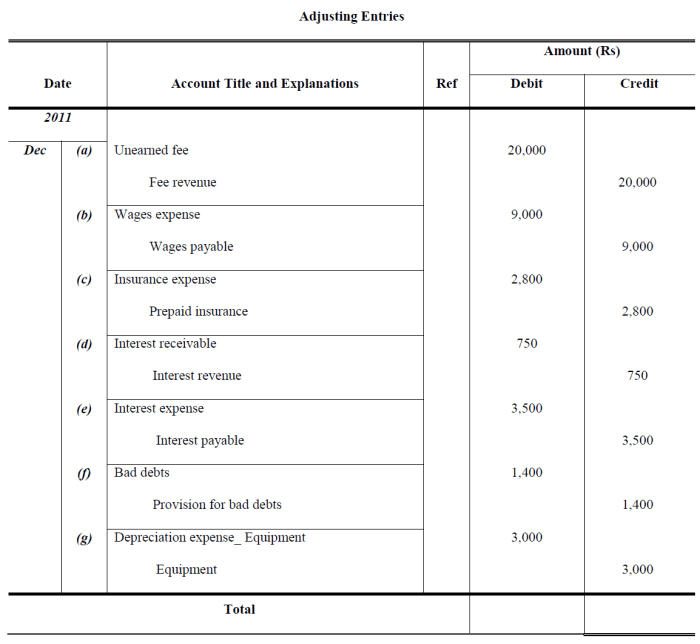

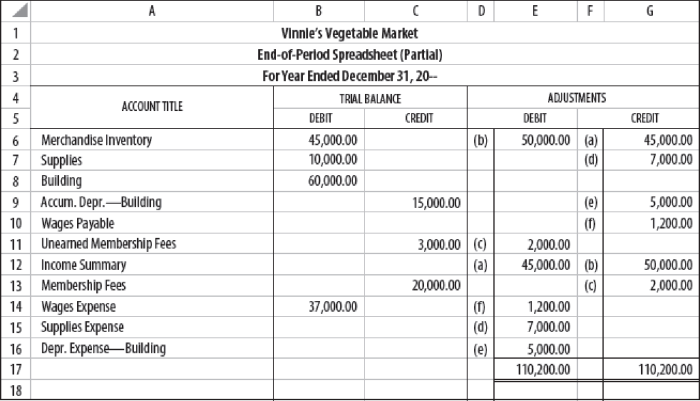

Adjusting entries are accounting entries made at the end of an accounting period to ensure that the financial statements are accurate and up-to-date. These entries are used to record transactions that have occurred but have not yet been recorded in the accounting system.

The purpose of adjusting entries is to bring the accounting records into agreement with the actual financial position of the business. This is necessary because the accounting system is based on the accrual method of accounting, which means that transactions are recorded when they occur, regardless of when cash is received or paid.

However, some transactions may not be recorded until after the end of the accounting period, such as accrued expenses or prepaid expenses.

Types of Accounts Affected by Adjusting Entries

Adjusting entries can affect any type of account, including assets, liabilities, equity, revenue, and expenses. The most common types of accounts affected by adjusting entries are:

- Accrued expenses: Expenses that have been incurred but not yet paid.

- Prepaid expenses: Expenses that have been paid but not yet used.

- Deferred revenue: Revenue that has been received but not yet earned.

- Unearned revenue: Revenue that has been earned but not yet received.

Timing of Adjusting Entries, Which of the following is a characteristic of adjusting entries

Adjusting entries are typically made at the end of an accounting period, such as monthly, quarterly, or annually. However, some adjusting entries may be made more frequently, such as daily or weekly.

The timing of adjusting entries is important because it ensures that the financial statements are accurate and up-to-date. If adjusting entries are not made, the financial statements may not accurately reflect the financial position of the business.

Frequently Asked Questions

What is the primary purpose of adjusting entries?

Adjusting entries serve the critical purpose of updating accounting records to reflect the accrual basis of accounting, ensuring that financial statements accurately capture all transactions that have occurred during an accounting period, regardless of whether cash has been exchanged.

What are the key types of adjusting entries?

Adjusting entries encompass a range of types, including accruals, deferrals, and estimations. Accruals recognize revenue earned but not yet billed or expenses incurred but not yet paid. Deferrals, on the other hand, allocate the cost of prepaid expenses or unearned revenue over the periods benefited.

Why is it crucial to make adjusting entries on a timely basis?

Timely recording of adjusting entries is paramount to ensure the accuracy and reliability of financial statements. Delaying or omitting adjusting entries can result in financial statements that do not accurately reflect the company’s financial position and performance, potentially misleading stakeholders.