Dive into the world of insurance with our comprehensive cheat sheet property and casualty insurance study guide PDF. This meticulously crafted guide unlocks the secrets of property and casualty insurance, empowering you with the knowledge to navigate the complexities of this essential coverage.

From understanding different types of policies to calculating premiums and deductibles, this guide serves as your ultimate companion for exam preparation and professional development.

Property and Casualty Insurance Cheat Sheet: Cheat Sheet Property And Casualty Insurance Study Guide Pdf

This cheat sheet provides a comprehensive overview of property and casualty insurance, covering key concepts, coverage types, terminology, calculations, and study tips.

Cheat Sheet Structure

Design a visually appealing and easy-to-navigate cheat sheet that includes clear headings, subheadings, concise bullet points, and color-coding for important information.

Property Insurance Coverage

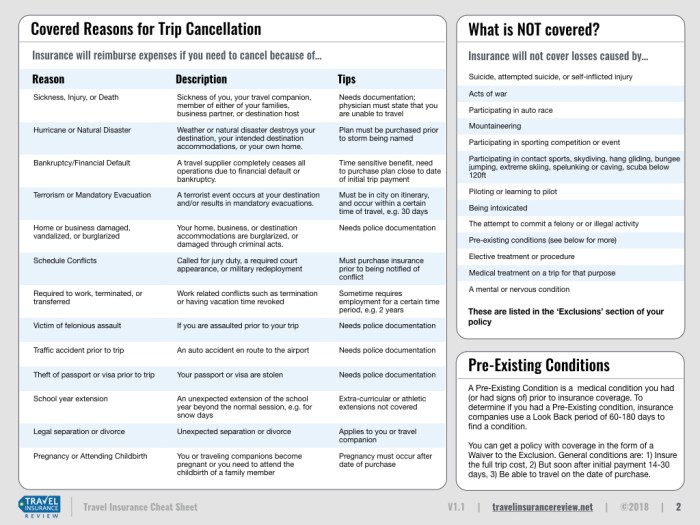

Property insurance protects against financial losses resulting from damage to or loss of property. Different types of property insurance policies include homeowners, renters, and commercial policies.

- Covered perils:Fire, theft, natural disasters, and more.

- Policy limits:Maximum amount of coverage.

- Deductibles:Amount paid out-of-pocket before insurance coverage kicks in.

- Exclusions:Situations not covered by the policy.

Casualty Insurance Coverage

Casualty insurance protects against financial losses resulting from bodily injury, property damage, or legal liability. Different types of casualty insurance include general liability, auto, and workers’ compensation.

- Covered events:Bodily injury, property damage, legal liability.

- Policy limits:Maximum amount of coverage.

- Deductibles:Amount paid out-of-pocket before insurance coverage kicks in.

- Exclusions:Situations not covered by the policy.

Insurance Terminology

Understanding key insurance terms is essential. Here are some common terms and their definitions:

- Premium:Amount paid to the insurance company for coverage.

- Deductible:Amount paid out-of-pocket before insurance coverage kicks in.

- Coverage limit:Maximum amount of coverage provided by the policy.

- Policy period:Duration of the insurance coverage.

Insurance Calculations, Cheat sheet property and casualty insurance study guide pdf

Insurance premiums and deductibles can be calculated using specific formulas:

- Premium calculation:Risk assessment + administrative costs + profit margin.

- Deductible calculation:Based on the policyholder’s risk tolerance and financial situation.

Factors that affect insurance costs include claims history, risk profile, and coverage limits.

Study Tips

Effective study strategies can enhance retention and understanding:

- Memorization techniques:Flashcards, spaced repetition.

- Practice questions:Solve mock exams, review previous questions.

- Time management:Prioritize topics, allocate study time wisely.

- Exam preparation:Review notes, identify areas for improvement, seek clarification if needed.

FAQ Insights

What is the purpose of this cheat sheet?

This cheat sheet provides a concise and comprehensive overview of property and casualty insurance, serving as a valuable study guide for exams and professional development.

What types of insurance are covered in this guide?

The guide covers both property insurance (e.g., homeowners, renters, commercial) and casualty insurance (e.g., general liability, auto, workers’ compensation).

How can I use this cheat sheet effectively?

Maximize the effectiveness of this cheat sheet by reviewing its contents regularly, utilizing its clear structure and concise bullet points for quick reference, and applying its practical tips to your insurance-related endeavors.