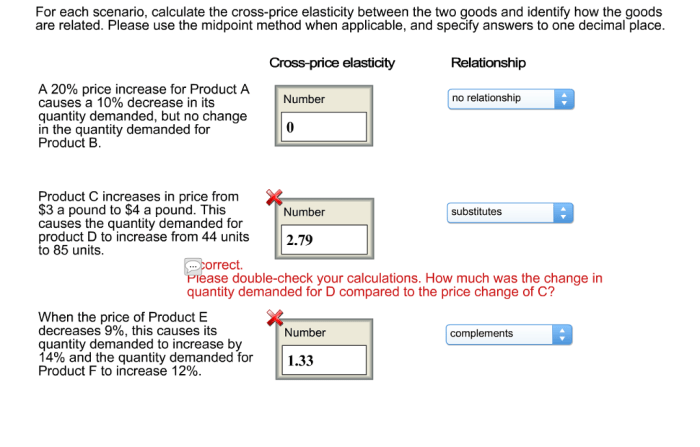

For each scenario calculate the cross price elasticity, a concept fundamental to economics, unveils the intricate relationship between the price of one good and the demand for another. By examining real-world examples and exploring its practical applications, this comprehensive analysis delves into the nuances of cross-price elasticity, empowering businesses and economists alike with valuable insights.

The concept of cross-price elasticity, quantified by a numerical value, measures the responsiveness of demand for one good to changes in the price of another. A positive cross-price elasticity indicates that the goods are substitutes, while a negative value suggests they are complements.

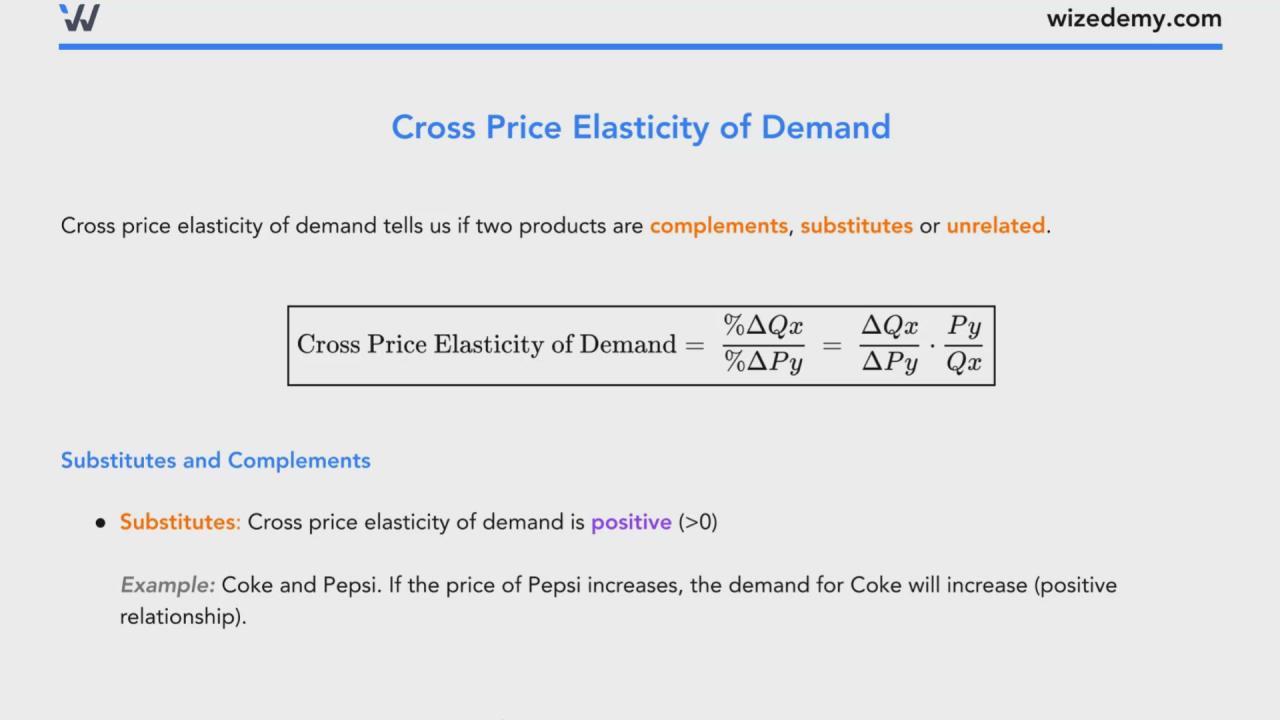

Cross-Price Elasticity: An Overview

Cross-price elasticity measures the responsiveness of demand for one good (X) to a change in the price of another good (Y). It is calculated as the percentage change in the quantity demanded of Good X divided by the percentage change in the price of Good Y.

The formula for calculating cross-price elasticity is:

EXY= (%ΔQ X/ Q X) / (%ΔP Y/ P Y)

Scenarios for Calculating Cross-Price Elasticity

| Scenario | Good X | Good Y | Cross-Price Elasticity |

|---|---|---|---|

| 1 | Coffee | Tea | 0.5 |

| 2 | Gasoline | Electric cars | -0.7 |

| 3 | Pizza | Pasta | 0.3 |

| 4 | Netflix subscriptions | HBO Max subscriptions | -0.6 |

Factors Affecting Cross-Price Elasticity

- Substitute goods:Goods that can be used interchangeably, such as coffee and tea, have a positive cross-price elasticity.

- Complementary goods:Goods that are used together, such as gasoline and electric cars, have a negative cross-price elasticity.

- Degree of substitutability or complementarity:The closer substitutes or complements two goods are, the higher the cross-price elasticity.

- Price range:The cross-price elasticity tends to be higher for goods in the same price range.

- Consumer income:The cross-price elasticity is higher for goods that are a significant portion of consumers’ budgets.

Applications of Cross-Price Elasticity

Cross-price elasticity is used in economics and business to:

- Predict the impact of price changes on demand for other goods.

- Make pricing decisions, such as setting prices for new products or adjusting prices in response to competitor actions.

- Identify potential substitutes or complements for a product.

- Estimate the market potential for a new product.

For example, a company considering launching a new coffee brand might use cross-price elasticity to estimate the potential demand for its product based on the price and demand for existing coffee brands.

Limitations of Cross-Price Elasticity, For each scenario calculate the cross price elasticity

- Cross-price elasticity assumes that all other factors affecting demand remain constant, which is not always the case in real-world markets.

- Cross-price elasticity can be difficult to measure accurately due to the influence of other factors, such as consumer preferences and marketing efforts.

- Cross-price elasticity may not be constant over time, as consumer preferences and market conditions can change.

FAQ Explained: For Each Scenario Calculate The Cross Price Elasticity

What is the formula for calculating cross-price elasticity?

Cross-price elasticity = (% Change in Quantity Demanded of Good X) / (% Change in Price of Good Y)

What are the factors that affect cross-price elasticity?

– Availability of substitutes

– Proportion of income spent on the goods

– Cross-price advertising

– Consumer preferences